Beware Noncompliance With Wooden Packaging Will Result In High Exit Fees

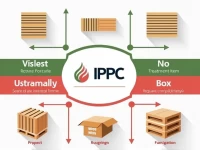

Recently, customs reports indicate a significant increase in non-compliance issues related to wood packaging in our country. Packaging that lacks the International Plant Protection Convention (IPPC) mark or is found to contain live harmful organisms may lead to goods being rejected and incurring high costs. Companies must strictly adhere to wood packaging quarantine standards to avoid economic losses.